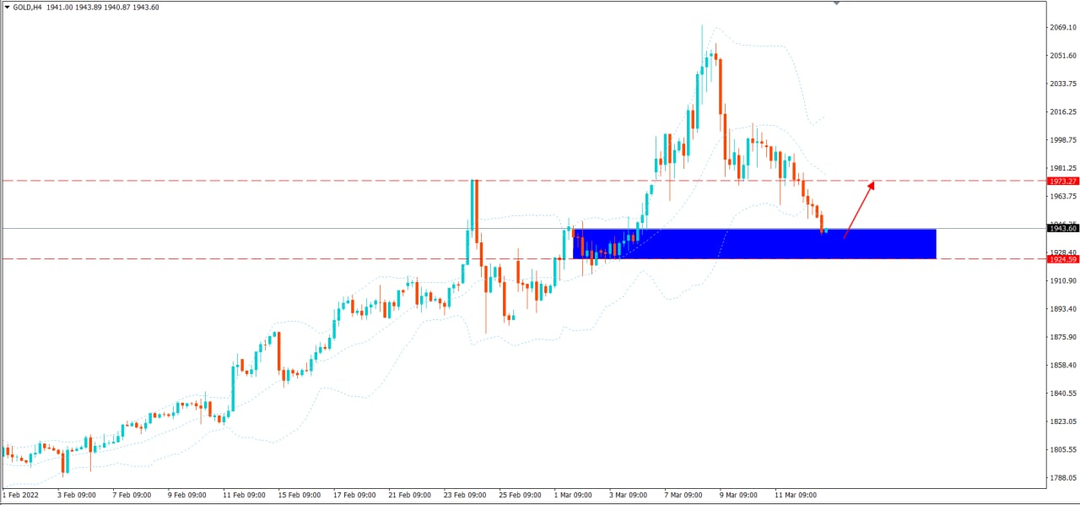

Comment on Gold on March 31, 2022:

📕 Comment on Gold on March 31, 2022: - In yesterday's trading session, precious metal Gold bounced up exactly as analyzed when it increased from 1915 to 1938 ($23), closing the day session with a bullish candle around the 1932 price range. closed with a bullish candle, but in my opinion, this upward force is not strong and has not reflected much, it is likely that there will be 1 more decline before increasing again. - My personal view in today's trading session is that Gold will drop to around 1908-1914. Here we will look at the possibility of buying this precious metal. I will update then.