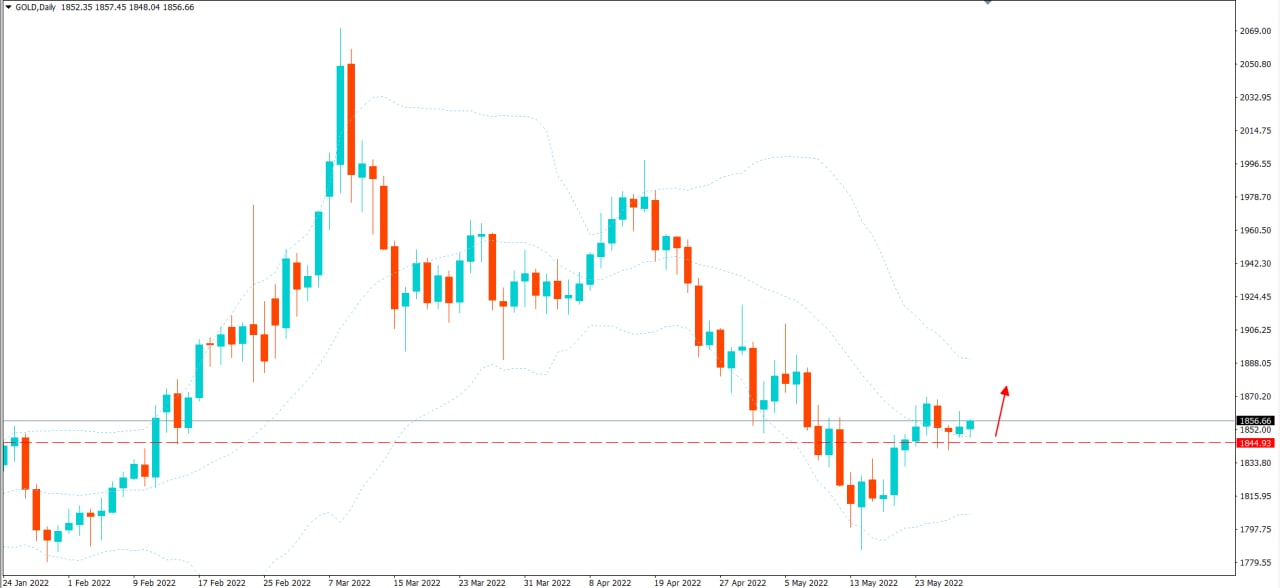

📕 Comment on Gold on May 31, 2022: - Currently, precious metal Gold does not have too much volatility, moving sideways in the range of 1845-1863. Closing yesterday's session Gold ended with a green candle around 1855. This candle hasn't reflected much but we can see that the downward pressure is quite weak and the uptrend is still preferred. - My personal opinion will wait to buy when Gold has 1 more downtrend. The expected price area to be able to establish a buy position is around 1835-1840. If in today's session, gold has a downward beat, this is an ideal price area for us to establish a buy position with a safe target around 1855.