📕 Comment on Gold on April 29, 2022:

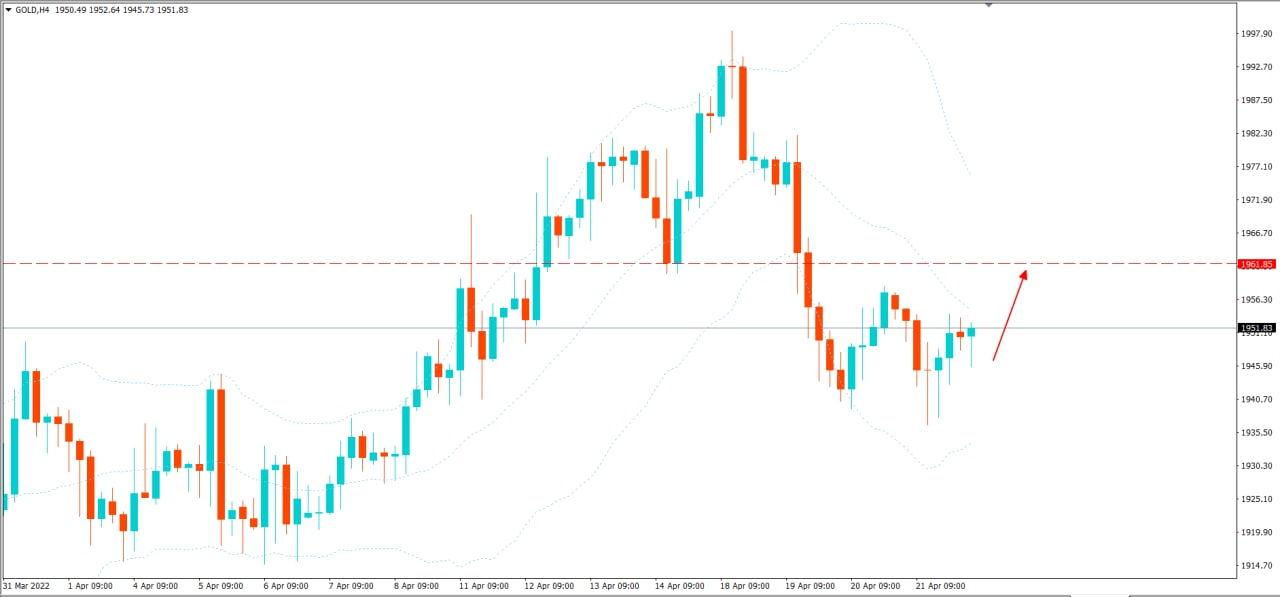

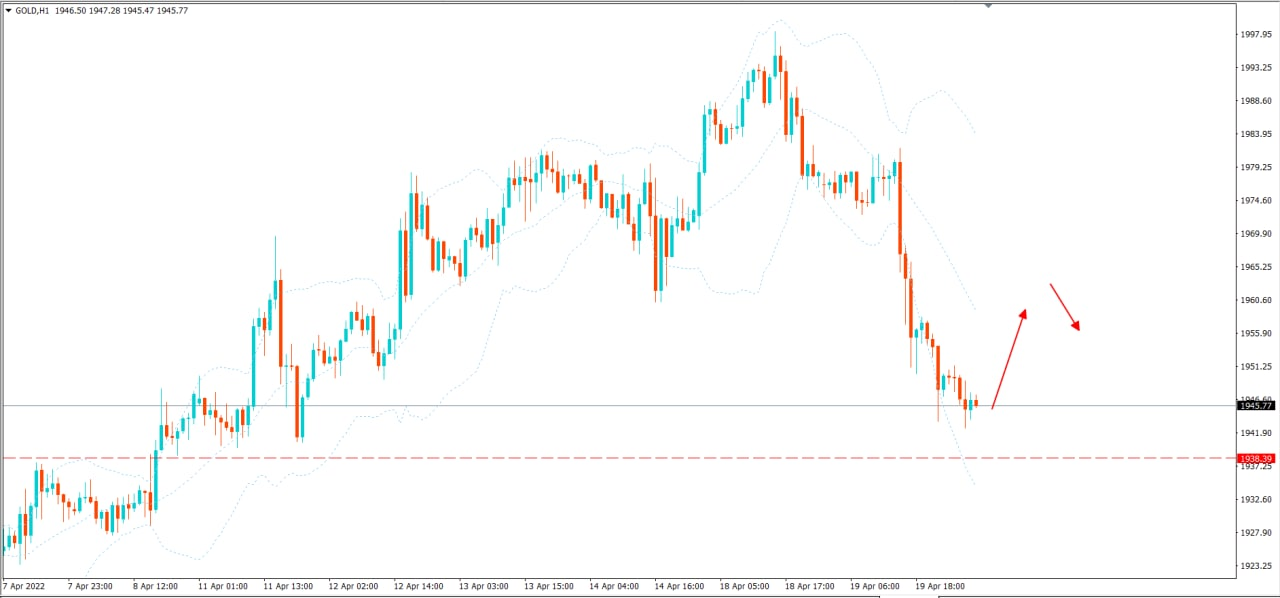

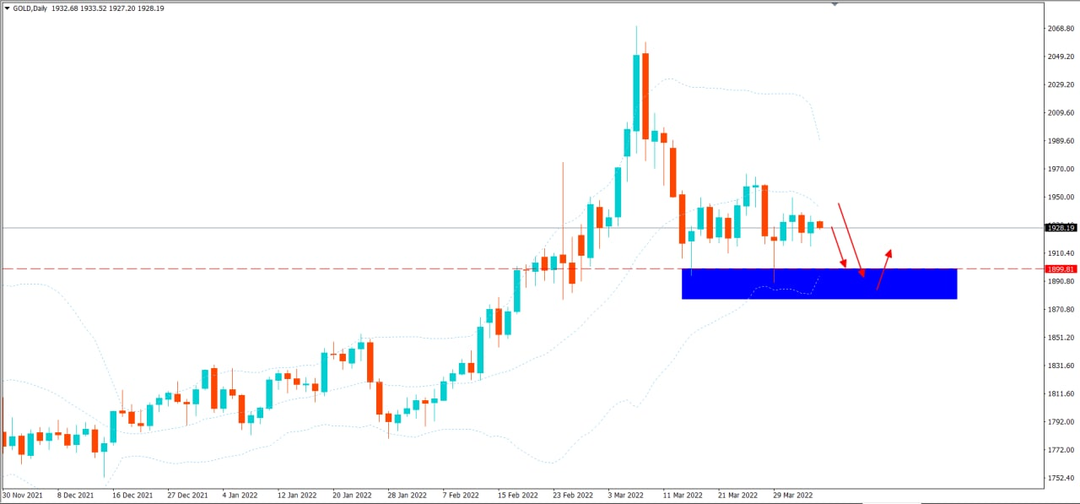

📕 Comment on Gold on April 29, 2022: - In yesterday's trading session, after precious metal fell to 1871, Gold rallied strongly to 1896 ($25), closed the day session with a bull pusher and in the early morning of this day Gold continued to rise. up to around 1905. With the current showing of good upward momentum, my view will be to prioritize the bullish option for this precious metal. - On the H4 time frame, bullish force also prevails and the nearest support area for this precious metal is around 1895-1898, Here we can establish a buy position with a safe target around the threshold. 1910-1915.